Article: 5 Tactics To Overcome Technology & Innovation Adoption Challenges In Clinical Research

By Dennis Salotti, COO, The Avoca Group

ClinicalLeader.com – August 15, 2019

Our global digital population – people around the world that are active internet users – has grown to 4.3 billion as of July 2019, representing roughly 56 percent of the global population.1 Of this global digital population, almost 4 billion are accessing the internet using mobile devices, with non-tablet mobile devices contributing nearly half of web page views worldwide.2

Use Of Digital Technologies In Clinical Research

With this move into the digital world, how we find and access goods and services has changed. A few clicks on our phone deliver our essential human needs for food, clothing, and shelter via services such as HelloFresh, Stitch Fix, and Airbnb. Healthcare services are also now accessed using established platforms for telemedicine clinician visits, recently cleared digital therapeutics, and a variety of mobile health monitoring devices and applications.

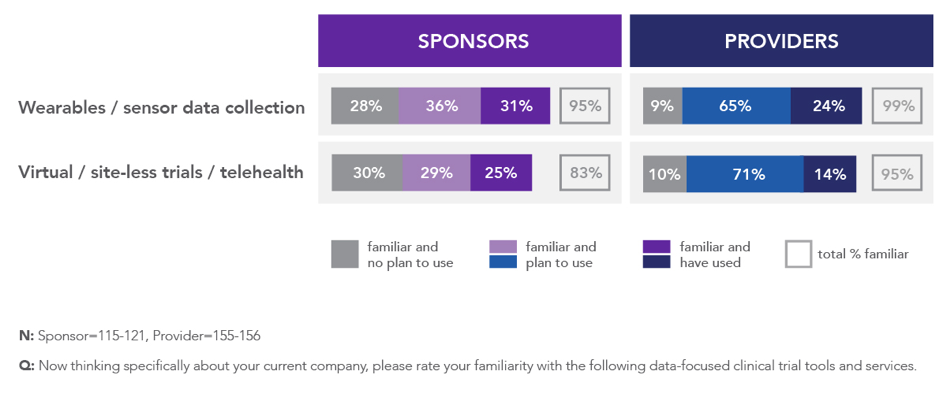

However, we see a much different picture when we consider the research and development of new medicines. According to research released by The Avoca Group in May 2019,3 the overall utilization of mobile health technologies and virtualized approaches to clinical trials, including telehealth, is low among sponsors and providers – ranging from 14 percent to 31% percent among the nearly 300 respondents (Figure 1). However, at least the same proportion of respondents indicated plans for future use of these technologies and approaches. This was particularly true for providers, which might reflect their anticipation of a greater appetite among sponsors and the opportunity to differentiate in this space.

Figure 1: Familiarity and Use of Wearable/Sensor Technology and Virtualized Trial Approaches Among Sponsors and Providers3

A Pilot Paradox

Addressing this disconnect between our observations within the walls of our companies and those happening across the global healthcare and technology landscape requires an understanding of the challenges and their relative contribution to our laggardly adoption of technology and innovation in clinical research. One key insight arises from the same research by The Avoca Group, comparing the level of investment, experimentation, and scale-up adoption reported in 2018 with that reported in the 2015 survey.

The results indicate that, as an industry, we have created a paradox – increased investment and experimentation with a concurrent regression in adoption. Greater proportions of sponsors indicated that their companies were both investing the appropriate monies and resources into innovation (+20 percent) and willing to both try and fail in the pursuit of innovation (+12 percent). However, the opposite trend was observed when asked whether their company recognizes and adopts innovative approaches to clinical development that are shown to be successful – with a 6 percent decrease in the number of sponsors responding favorably. The memes commonly prevalent in clinical research – resource constraints and failure aversion – are not currently key challenges and, yet, we seem to be stagnant, at best, in our progress toward greater adoption of technology and innovation even in the face of success.

Why are we, as an industry, seemingly trapped at the pilot stage of investment and experimentation while failing to commit to adoption even when an innovative approach to clinical research has demonstrated success? Is it a fear of creative destruction and disruptive change to clinical trial design and conduct? Or, are we stuck in our thinking that transformative innovation occurs through single swan events,4 as opposed to the confluence of many micro-innovations and point solutions within the complex ecosystem of clinical research?

Understanding The Challenges To Broad Adoption

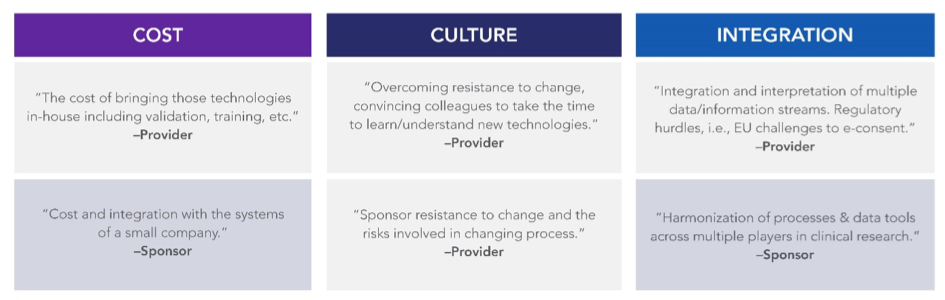

In response to an open-ended question regarding the primary challenges they face in using novel data sources and technologies in clinical trials, the themes for both sponsors and providers centered around cost, culture, and pragmatic challenges with integration (Figure 2).

Figure 2: Open-Ended Responses Regarding Primary Challenges Sponsors and Providers Face in Using Novel Data Sources and Technologies in Clinical Trials3

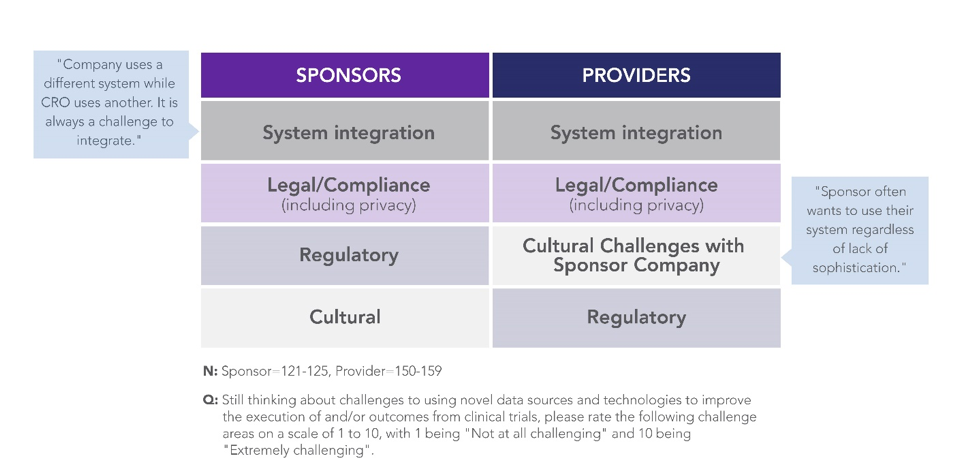

When asked to directly rate their challenges, sponsors and providers were aligned around a common set of challenges: system integration, legal compliance (including privacy), regulatory compliance, and culture (Figure 3). These findings illustrate a key opportunity area for collaboration – to share best practices and demystify compliance frameworks for implementing innovative approaches and technologies at scale in clinical development.

Figure 3: Top-Ranked Sponsor- and Provider-Reported Challenges to Adopting Novel Data Sources and Technologies in Clinical Trials3

5 Tactics To Overcome The Challenges And Enable Innovation

When The Avoca Group spoke to sponsors and providers about how to overcome their challenges, a key theme emerged for each: sponsors focused their recommendations on the innovative solutions themselves, while providers’ advice centered around the behaviors needed to readily adopt the solutions.

Below are five key tactics for sponsors and providers to implement, both within their individual companies and collectively as an industry, to break through the challenges associated with adopting transformative approaches, novel endpoints, and innovative technologies in clinical research:

1. Illustrate how data security, data quality, and data integrity are designed into the solution.

Among sponsors’ topmost concerns is ensuring that data collected using new technologies maintains its integrity and quality. In addition, they are concerned with protecting both their data asset and the privacy of trial participants, as one sponsor responded: “Focus on educating and demonstrating around data privacy and data security.”

We recommend clear illustration and documentation of data flow, including defining how data will move between third parties and third-party systems and the controls in place to ensure security and integrity throughout the data chain of custody. Clear communication and understanding around these aspects of newer technologies support effective oversight and proactive quality and risk management.

2. Use collaboration as a fulcrum.

Precompetitive collaboratives and pooling collective intelligence around prescient industry challenges have become critical vehicles to address industry challenges. Collaboratives among common stakeholders create a more liquid market for information and more efficiently raise awareness and education around issues and opportunities the industry shares as peers. Across stakeholder groups, collaboratives create an environment for cross-communication across departments, companies, points of view, or other boundaries that would otherwise suffer from silos of information and perspectives. Collaboration is sought by sponsors, as indicated by this response in the survey: “Collaboration and communication with regulators and other industry personnel to determine how to utilize the technologies and understand what expectations are from regulatory agencies.”

Adoption of new technologies and innovative approaches to clinical research, including increased virtualization of clinical trials, create challenges and opportunities that span the pragmatic through the philosophical. Collaboration is the fulcrum we should leverage to maximize how we handle these challenges and opportunities as an industry.

3. Focus on risk management and change management.

Risk and change management are disciplines that have a great deal in common and are especially important for the adoption of innovative technology, data sources, and approaches to clinical research that reinvent long-standing designs.

- Awareness: Whether it relates to a potential risk or an area where change is needed, awareness is a prerequisite to designing an effective risk and change management plan that will facilitate successful implementation of a new technology or data source. Industry research, benchmarking, and networking within communities of practice such as the collaboratives already discussed all raise awareness of the opportunities, risks, and challenges. They also serve as sources of ideas and approaches to encourage successful risk mitigation and optimized opportunities.

- Knowledge and Capability: Acquiring the necessary knowledge and capabilities to identify a risk or opportunity and subsequently mitigate or leverage it, respectively, is a keystone element to drive results. Sponsors and providers alike can take advantage of a variety of investments to acquire the necessary knowledge and capabilities to drive adoption of innovation, including investments in partnerships such as that recently announced by Verily and four large pharmaceutical sponsors5 and from acquiring new and diverse talent from complementary areas and existing staff. Sponsor respondents desire their companies to “be supportive of innovation and willing to invest up front for future savings in time or money.”

- Rewards and Recognition: Finally, visible, consistent reward and recognition of skill, savvy, and behavior aligned with thoughtful adoption of innovation are necessary to create momentum behind the movement. This will move minds and actions toward adopting, rather than fearing or resisting, the changes necessary to transform clinical research. Investing in an appropriately designed incentive scheme – which might require a fundamental redesign to the existing system of rewards and performance management – is as critical as the investments in other pieces of technology and infrastructure. In The Avoca Group’s survey, a provider respondent vocalized this point in this manner: “Reflect the value of innovative approaches more concretely. Put skin in the game for outcomes of these alongside better research into the value proposition.”

4. Invest in cross-disciplinary staff development.

As already described, developing the knowledge and capabilities of existing staff is a key element of change management and an important, if not overlooked, investment to expedite adoption and value recognition of clinical innovation. “Smart” technologies, such as those powered by artificial intelligence (AI) tools (machine learning, natural language processing, and other forms of decision support and automation), are not smart or intelligent in and of themselves. They become so from the highly skilled operators that train them and use their outputs to shape decisions and actions. Accordingly, to understand how to interact with these technologies, clinical trial professionals should receive holistic, interdisciplinary training to understand the capabilities and limitations of the information they provide and to influence the roles these technologies play in an increasingly complex drug development ecosystem where regulatory, privacy, security, and ethical requirements are being rethought. There is a recognized need for “industry-wide skilling up effort for staff in many disciplines,” according to a provider respondent.

5. Lead by example and action.

The final tactic to overcome challenges in adopting technology and innovation in clinical research is to lead by example. Whether a CEO or CRA, every clinical trial professional has the opportunity to contribute leadership and action to the biopharma industry’s transformation. Different from the other four areas of recommendations, this last tactic requires only a decision. As individuals, we must each make the decision to lead and take action – in whatever capacity our role affords us – to help bring about transformational change – at our companies and as an industry – in how we enable adoption of innovative technology and data sources in clinical research. A sponsor respondent suggested taking “a leading approach by going to regulatory bodies with new data sources versus waiting for guidance from the regulatory bodies,” while a provider respondent provided this advice: “Remain open minded. Accept given levels of risk.” Both statements speak to the baseline requirements of trying new data/tech.

Conclusion

By investing in, but not implementing, technologies and innovations that have demonstrated success in clinical trials, we are missing an opportunity to more efficiently advance drug development. Sponsors and providers alike can leverage these five key areas to overcome their challenges to adoption and drive change within their organizations and the industry as a whole.

References:

- Clement J. Global digital population as of July 2019 (in millions). Statista. July 18, 2019. Accessed on July 23, 2019. Available at https://www.statista.com/statistics/617136/digital-population-worldwide/

- Clement J. Mobile internet traffic as percentage of total web traffic in February 2019, by region. Statista. July 22, 2019. Accessed on July 23, 2019. Available at https://www.statista.com/statistics/617136/digital-population-worldwide/

- The Avoca Group. The 2018 Industry Research Report: Perspectives on Clinical Innovation & Technology. May 2019. Available at: http://www.theavocagroup.com/wp-content/uploads/2019/05/2018-Avoca-Industry-Report_Innovation.pdf

- Taleb NN. The Black Swan: Second Edition: The Impact of the Highly Improbable (Incerto Book 2). 2010. Random House.

- Verily forms strategic alliances with Novartis, Otsuka, Pfizer and Sanofi to transform clinical research. Business Wire. May 21, 2019. Available at https://www.businesswire.com/news/home/20190521005485/en/Verily-Forms-Strategic-Alliances-Novartis-Otsuka-Pfizer. Last accessed on July 29, 2019.

To download the 2018 Avoca Industry Report, “Perspectives on Clinical Innovation & Technology” click the image below (or click here).