Article: Clinical Development Vendor Qualification: “Check-The-Box” Exercise?

By Jay A. Turpen, Senior Consultant, The Avoca Group

Contract Pharma – March 4, 2020

Key first steps to vendor risk management.

Are your company’s clinical development vendor qualification (VQ) activities a “Check-The-Box” exercise because someone said that regulators expect it? Or are your VQ activities a comprehensive first step in managing the risk of doing business with a new vendor?

Are your company’s clinical development vendor qualification (VQ) activities a “Check-The-Box” exercise because someone said that regulators expect it? Or are your VQ activities a comprehensive first step in managing the risk of doing business with a new vendor?

Today, almost all clinical trials are implemented utilizing multiple clinical vendors that provide key services that enable the clinical development process. Across the pharmaceutical industry, there are many differences in how companies approach this activity. In fact, the scope and approach of VQ activities vary significantly from company to company across the industry. The reality is that regulators—as outlined in ICH E6 R2 & ICH Q10—expect pharmaceutical companies to verify contracted vendors have adequate qualifications to complete the work they’re contracted to deliver. These VQ regulatory requirements impact both Sponsors and Vendors, with Vendors managing both evaluation by Sponsors for their qualifications and evaluation of their own sub-contractors that support clinical development efforts. Incrementally, revisions found in ICH E6 R2 also set expectations to establish a comprehensive Risk Management process which should include management of the risks associated with the work performed by contracted Vendors.

Beyond performing VQ for regulatory compliance, there is a tangible opportunity for a company to utilize their VQ efforts to initially assess vendor risk as part of their process to establish a vendor risk management plan. This foundational VQ assessment can provide early clarity on vendor risks in a new vendor relationship and allow a company to go into the relationship with their “eyes wide open.” Actions can be taken to remove, mitigate and/or closely monitor identified vendor risks to improve vendor performance. This proactive approach to managing vendor risks can lead to reduced clinical development risks, improved operational performance and faster clinical development cycle times.

In 2019, the Tufts Center for the Study of Drug Development (CSDD) and The Avoca Group collaborated to take the first comprehensive look at the VQ processes of Sponsors (Pharma & Biotech) and Vendors (CROs and other clinical service providers). To our knowledge, there have been no previous benchmarking studies performed to evaluate VQ processes for clinical development in the pharmaceutical Industry. This first of its kind benchmarking study provides insight into the current practices of the industry and reveals significant variability as to how the VQ processes are currently being managed.

Study design and population

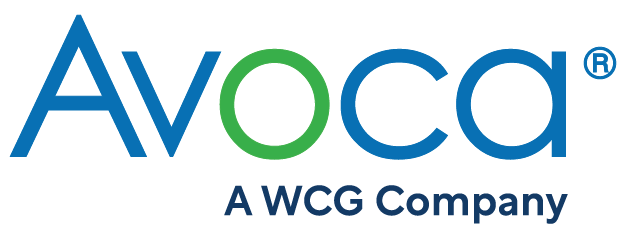

During the study, respondents were asked to provide data on their organization’s existing VQ processes including past and current volume, scope, cycle times and resources, as well as forecasts for future volume. The study included data from 120 unique companies that represented 78 Sponsors, 31 CROs and 11 other clinical service providers.

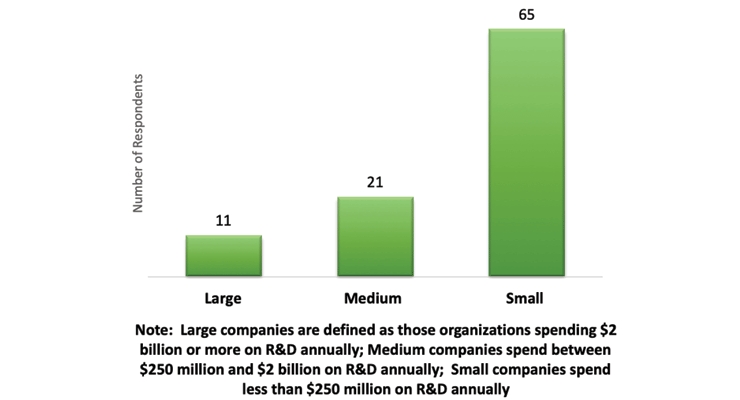

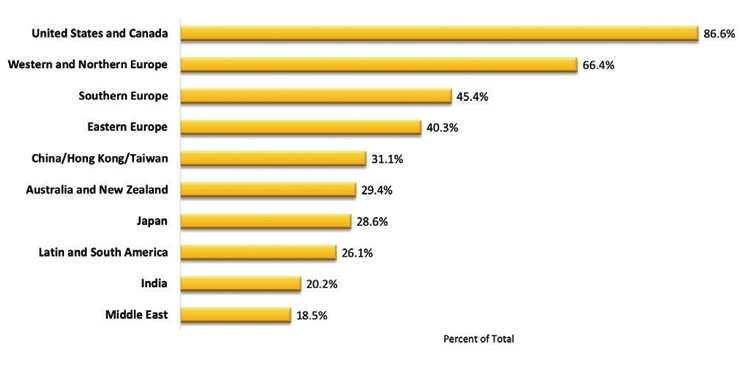

The participating companies represented a broad set of multinational organizations (Figure 2) as well as demonstrated large differences in their size as evaluated by the number of clinical development staff in full time equivalents (FTEs) of their respective organizations (Figure 3).

Figure 1 – Company Size

Figure 2 – Respondent Company Areas of Operation

Figure 3 – Mean Total Number of FTEs in Clinical Functions per Company

Vendor qualification assessment areas

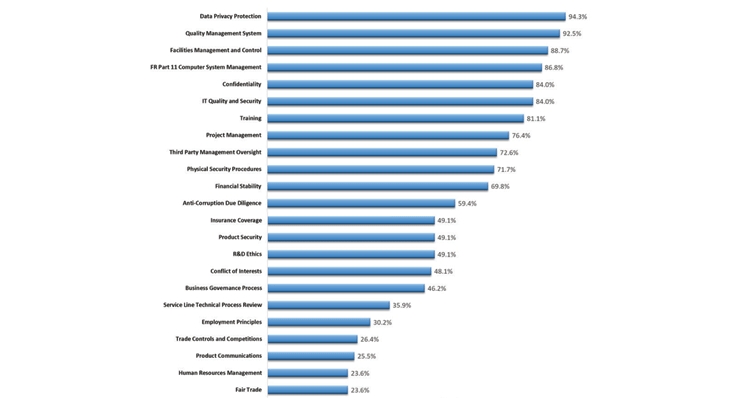

Although the ICH regulations require that contracting companies verify vendors are qualified to do the work and ensure vendor risks are effectively managed, there is limited guidance on exactly “how” this should be done. In the study, there was a detailed look at the areas each company evaluated (Figure 4) during the VQ assessment process and, as one might expect without specific regulatory guidance, there was significant variability around how each company implemented VQ across the industry. The assessment areas with the highest frequency of occurrence are likely being reviewed to ensure clinical development qualification. Those occurring with lower frequency are likely be used to support the evaluation of the various categories of vendor risk and used as the starting point for the development of specific vendor risk management plans. For example, the “Insurance Coverage” category is a very important topic to ensure certain vendor financial risks are appropriately covered by their insurance policies and reduces the overall sponsor financial risk for the work under contract.

Figure 4 – VQ Assessment Areas

Resource implications

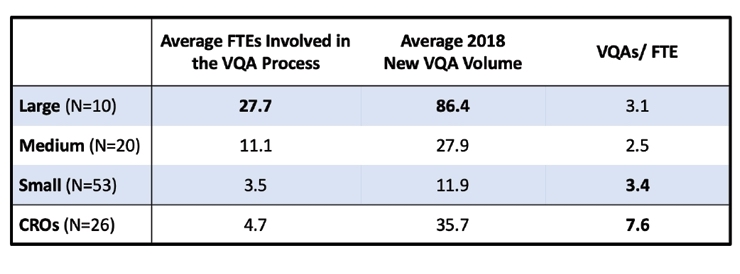

With this degree of process variation and inconsistency, the amount of resources applied to this process also varies greatly across the industry. Large companies have devoted more resources to each of their VQ assessments than medium or small companies. And as one might expect, the large companies also had the most significant VQ Assessment volume (Figure 5). Notably, the CROs have established the most resource-efficient process for qualifying their vendors when comparing the number of qualifications performed relative to the number of FTEs involved in the process. This resource productivity ratio for CROs was more than twice as efficient as their Sponsor counterparts.

Figure 5 – Workload of Initial VQAs per FTE 2018

Speed – cycle time implications

Pharmaceutical and biotech companies are doing their best to accelerate their clinical development timelines in order to bring new treatments to patients and achieve the desired return on their R&D investment. A frequent challenge for pharmaceutical companies is the length of time it takes to qualify a new vendor.

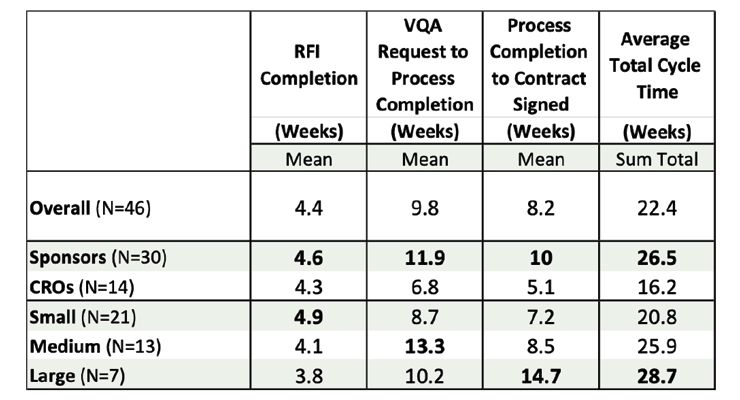

Today, the rapid development of new technologies, new biomarker assays and other emerging scientific approaches often present a challenge to drug developers. As they attempt to rapidly incorporate the latest scientific approach from a new vendor into their next clinical trial, they face reality that the VQ process must be completed. The desire to utilize the latest science from a new vendor is sometimes constrained by the lengthy VQ processes required to ensure the vendor is qualified. Predominately, the vendor qualification process starts with a Request For Information (RFI) to gather foundational vendor information, then, if the vendors RFI response appears to meet the organization’s operational and regulatory needs, a more formal Vendor Qualification Assessment (VQA) process is conducted.

Some companies perform VQAs virtually via email and with phone contact in an effort to minimize the time to complete the process. Others conduct on-site assessments with both Quality Assurance (QA) and technical experts interviewing vendor personnel and reviewing SOPs, observing equipment, and confirming the effectiveness of overall facility management. Yet other companies use a combination of both virtual and on-site evaluations to complete their VQA process. Larger companies have more distinct functional organizations (many functional silos) with narrow focus areas which leads to the fragmentation of VQA activities and delays in accomplishing the necessary assessments. Conversely, smaller companies have fewer organizational partitions (fewer functional silos) with key individuals possessing broader responsibilities in the VQA process, which aids in faster decision making. Combining RFI, VQA and Contracting Time, (Figure 6) one can see cycle times of 16 to 28 weeks to bring a new multi-service vendor on-board.

Figure 6 – Cycle Times for Vendor Qualification

This lengthy cycle time of 4 to 6 months is a significant barrier to bringing in newly identified vendors with new technologies into soon-to-start clinical trials. Pharmaceutical and biotech companies are under pressure to develop new treatments faster than ever. Incorporating new innovative technologies may help in characterizing a new drug but are harder to implement than existing technologies considering these long cycle times to qualify new vendors.

Vendor burden

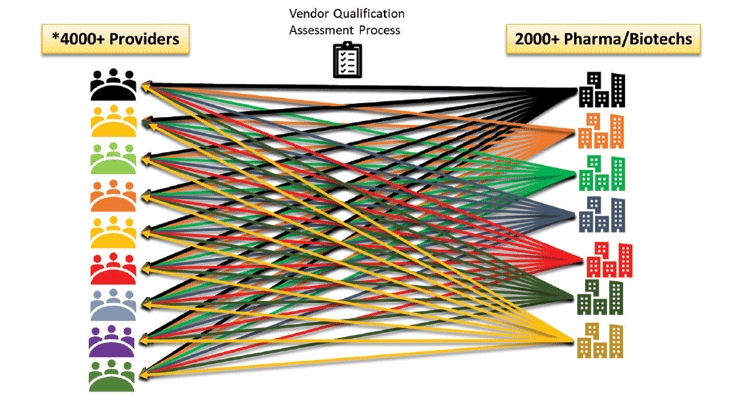

Vendors are given the heavy burden of hosting these VQAs by pharmaceutical companies. Each on-site visit by pharma staff requires vendors staff to spend time providing documents, answering questions and touring the operating facilities. A major CRO recently revealed that they host more than 250 Sponsor Qualifications Assessments per year. This means that, on average, they host one assessment for every working day of the year (Figure 7). An ever expanding 2000-plus Pharma & Biotech companies are evaluating a significant number of new vendors out of the rapidly increasing 4000-plus vendors providing clinical development services.

Figure 7 – Industry Current State

While sharing some similarities, each company’s VQA process approach is ultimately unique and often pursue different purposes—qualification vs. risk assessment or variations of both. This lack of utilized qualification standards and the process variability amplifies the burden for vendors. They must use a labor-intensive approach to ensure completed responses are accurate to the unique RFI and VQA processes used by each individual company. Even though this vendor effort may appear to be “free” to the sponsor, this vendor burden ultimately is reflected into the cost of drug development as this administrative overhead cost gets baked into vendor labor rates or into their fixed price bids.

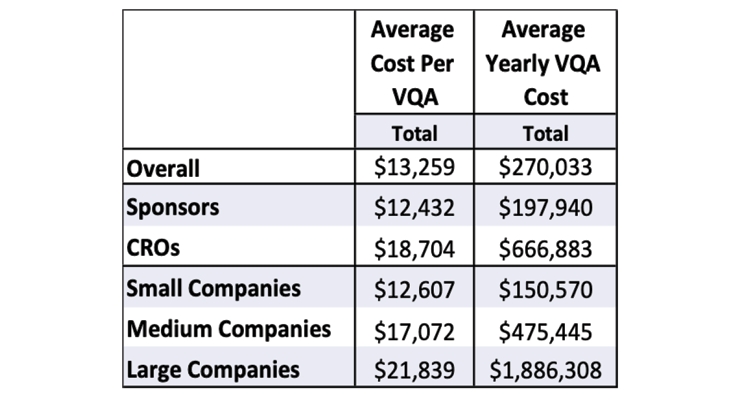

Overall costs

The financial impact of vendor qualification cannot be categorized as negligible as these expenses add to the cost of drug development and ultimately into the commercial costs of new drugs. While there is no single root cause or a silver bullet to fix the high cost of new drugs, make no mistake, the cost of vendor qualification (Figure 8) makes its way to patients. An estimated $130-$150 million is spent annually for on-site and remote new vendor qualification assessments. These costs in Figure 8 do not include the cost of periodically re-qualifying existing vendors or the indirect costs of distributing and evaluating RFIs.

Figure 8 – Costs of Vendor Qualification

A better way

All would agree that the pharmaceutical industry thrives on innovation. For several decades, we have witnessed an explosion of innovation that has led to impressive treatments in cardiovascular disease, cancer, lung disease, neurological diseases, immune diseases and many more. In 2019, life expectancies began to rise again. However, it’s safe to say that no company has a competitive advantage based on their innovative vendor qualification process. Some treat vendor qualification as a “check the box” exercise to meet some regulatory requirement. Others go farther and utilize the assessment process to improve risk management efforts with a new vendor. VQ costs are high and speed is too slow to keep pace with drug development timelines. This situation is ripe for finding a better way to verify vendor qualifications and manage risks while reducing redundancies.

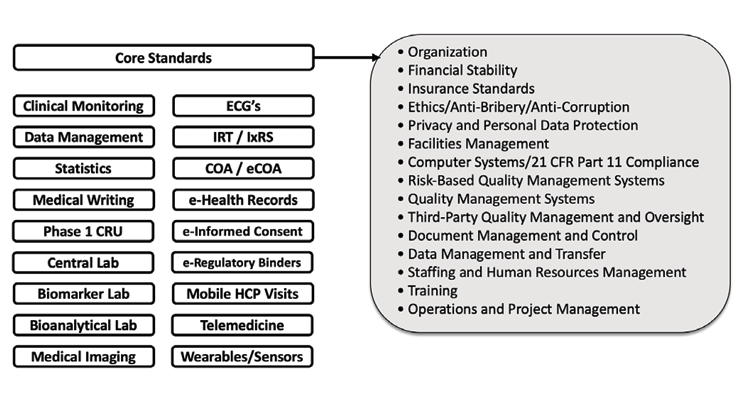

The Avoca Quality Consortium® (AQC), a collaboration of more than 100 sponsors, CROs and other clinical service providers, previously identified the lack of vendor qualification standards seven years ago. Through this collaboration, a very thorough set of vendor qualification standards (Figure 9) has been created for AQC member companies to utilize with the goal of improving the effectiveness and reducing the variability of these VQ processes. Core standards have been created that apply to all Vendors and separate technical standards were created for selection based on a vendor’s service offerings. These AQC qualification standards are living documents and continue to be updated based on AQC member feedback and as regulatory requirements evolve.

Figure 9 – AQC Vendor Qualification Standards

Recently, The Avoca Group initiated their Diligent® Qualification Platform service offering which built upon the AQC qualification standards and introduced a better way to manage vendor qualification.

Diligent’s basic premise is that RFI and VQA information should be assembled once by the independent Diligent process and utilized many times by multiple pharmaceutical and biotech companies.

Diligent offers Sponsors and CROs an opportunity to outsource their RFI and VQA processes and benefit from a shared resource of available vendors, capabilities and qualification information. The Diligent intuitive technology platform and suite of quality assurance assessment and auditing services, streamlines Sponsors and CROs approach to vendor qualification. When existing Diligent RFIs or VQA reports exist, the vendor qualification cycle time is shortened to a few days.

This solution aims to reduce the vendor burden, reduce resource consumption, reduce cycle times ultimately reduce costs for the participating companies. This new approach rethinks how the industry may achieve both regulatory compliance and establish an initial risk assessment that supports organizations risk management efforts without increasing resource overhead.

Conclusion

The high-level regulatory requirements are established in ICH E6 R2 and ICH Q10 but lack specificity regarding how to implement vendor qualification within individual companies. The industry’s current state is highly variable with significant differences in the scope of VQ activities. The resource, time and cost burdens to both Sponsors and Vendors is significant, which ultimately adds to the cost of drug development, and are ripe for process improvement. The Avoca Group’s Diligent Qualification Platform service offering is one approach the industry can take to reduce variability, costs and cycle times while improving the quality of vendor qualification information to ensure compliance and establish an initial baseline assessment supporting vendor risk management efforts.

Jay Turpen is a Senior Consultant with The Avoca Group. He has been in the pharmaceutical industry for 30 years and has held various leadership roles. Jay has a wealth of experience in GMP, GLP, and GCP environments with significant real-life experience in developing numerous new drug candidates.